Loading market data...

Reviewed and Rewrite by

Reviewed and rewritten by Finscann News Team

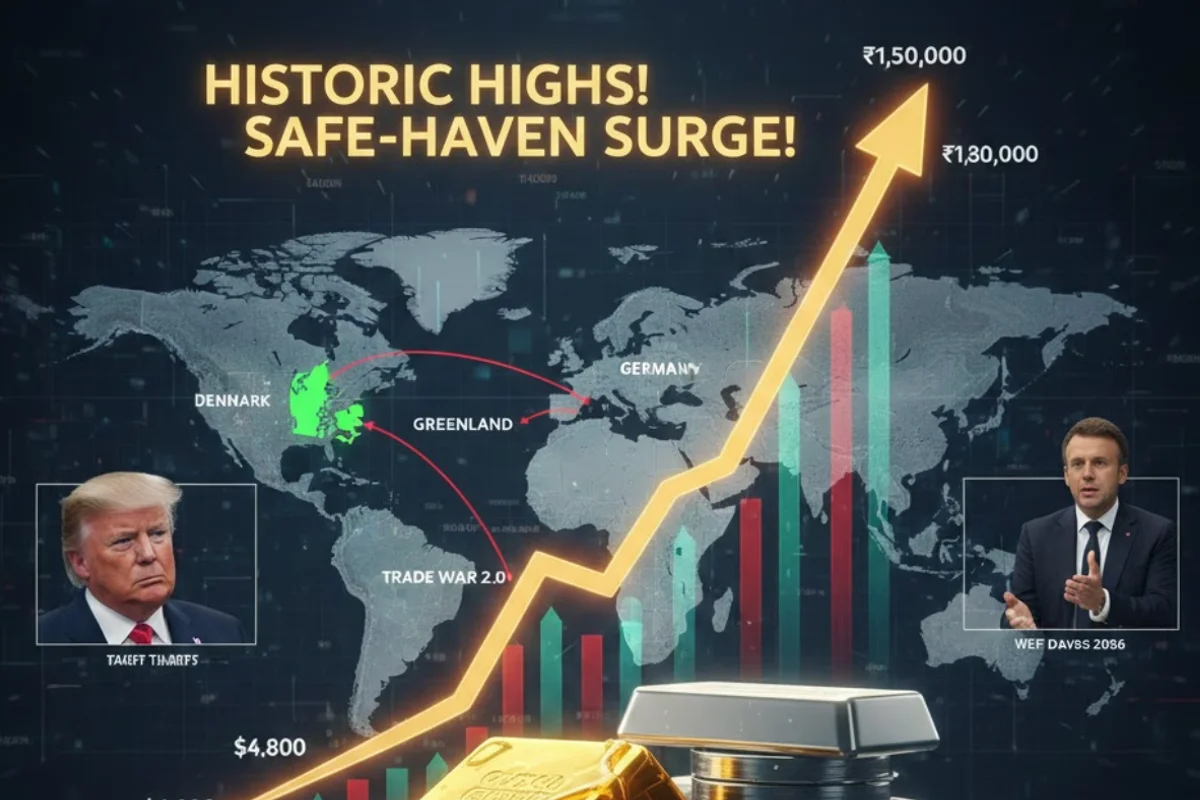

Bullion Breakthrough: Gold and Silver Hit Historic Highs Amid Greenland-Linked Trade Fears

The global commodity markets are witnessing a "stratospheric" rally as Gold and Silver smash all-time records in both international and domestic markets. Driven by a perfect storm of geopolitical anxiety, trade war threats, and a weakening U.S. dollar, precious metals have solidified their status as the ultimate safe havens for 2026.

At the heart of this surge is a bizarre yet high-stakes diplomatic standoff: U.S. President Donald Trump's renewed push to acquire Greenland and the subsequent threat of punitive tariffs on European nations that oppose the move.

1. Record-Breaking Performance: January 2026

The price action in the third week of January has been nothing short of historic. On the Multi Commodity Exchange (MCX), gold breached the psychologically significant ₹1.5 lakh barrier, while silver delivered staggering double-digit returns in just two sessions.

| Metal | MCX Record High (Jan 2026) | Global Spot/Futures Peak | Key Milestone |

|---|---|---|---|

| Gold | ₹1,52,500 per 10g | $4,888.13 /oz | Crossed ₹1.5L / $4,800 for the first time |

| Silver | ₹3,27,998 per kg | $95.41 /oz | Jumped ₹1 lakh in just 25 trading sessions |

2. The Greenland Catalyst: Trade War 2.0

The primary trigger for this "Safe-Haven Rush" is the escalating friction between Washington and Brussels.

3. Silver: The "Shining Star" of 2026

While gold often grabs headlines, silver has outperformed its yellow counterpart in early 2026.

4. Impact on Indian Retail and Jewelry

The sudden spike has had a visible cooling effect on physical consumption in India.

Looking Ahead: Will Gold Hit $5,000?

Major global banks, including Citigroup and UBS, have revised their 2026 forecasts, suggesting that Gold could reach $5,000/oz and Silver could hit $100/oz within the next few months if geopolitical tensions do not subside.

However, analysts at Kedia Advisory and Reliance Securities warn of potential "mean reversion" risks. After such a vertical rally, a short-term correction or time-based consolidation is likely as traders look to book profits near these historic peaks.

Disclaimer: The information provided in this article is for educational and informational purposes only. Commodities and stock market investments are subject to market risks. Always consult with a SEBI-registered financial advisor before making any investment decisions.