Loading market data...

Reviewed and Rewrite by

Reetesh Kumar

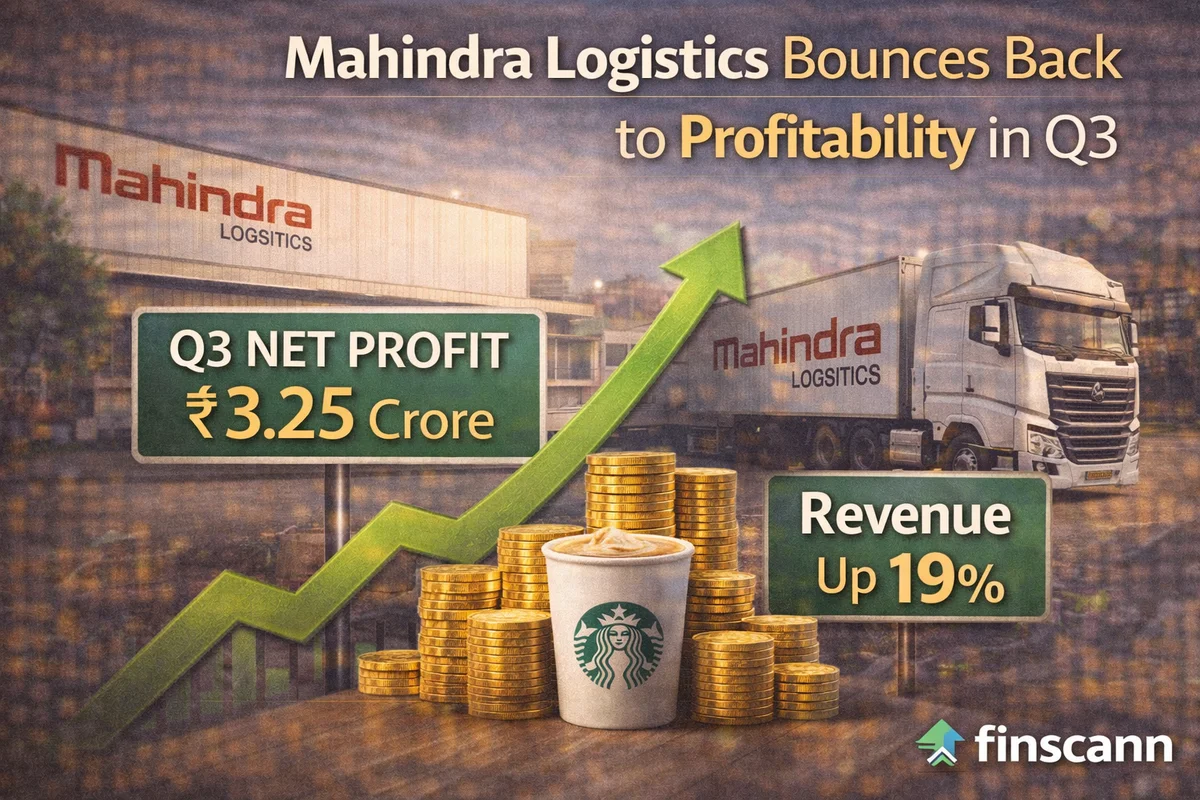

MUMBAI — January 27, 2026 — Mahindra Logistics Limited (MLL) has reported a decisive return to profitability in its third-quarter (Q3 FY26) results, ending December 31, 2025. The consolidated performance highlights a significant operational recovery, with the company posting a Net Profit of ₹3.25 crore, successfully reversing a loss of ₹9.03 crore from the same period last year.

This turnaround is underpinned by a robust 19.1% year-on-year increase in revenue, which climbed to ₹1,898.03 crore, driven by strong festive demand and strategic expansion in its core supply chain segments.

1. Key Financial Highlights: The Recovery in Numbers

Despite the broader market facing headwinds, Mahindra Logistics' "bottom-line" success was achieved even after absorbing a one-time exceptional charge related to India's new labor regulations.

2. Segment Performance: Beyond the Core

The 19% revenue surge was not isolated; it reflected growth across the company’s diversified portfolio:

3. Strategic Moves and Acquisitions

To solidify its market position, Mahindra Logistics has been aggressively refining its asset-light model:

4. Looking Ahead: The Union Budget 2026 Catalyst

As the Indian markets brace for a wave of earnings reports, the timing of MLL’s turnaround is critical. With the Union Budget 2026–27 scheduled for presentation in just a few days, the logistics sector expects significant tailwinds:

FinScann Take: Investor Confidence Restored

Mahindra Logistics has demonstrated that it can grow its top line while navigating complex regulatory shifts like the new Labour Codes. The successful integration of recent acquisitions and the 19% revenue growth suggest that the company’s "Integrated Solutions" strategy is gaining traction with high-value clients in the Auto, E-commerce, and FMCG sectors.

For investors, MLL now represents a "growth-at-reasonable-price" play in a sector that is the backbone of the "Make in India" ambition.

This article is for informational purposes only and does not constitute financial advice. Trading in equities involves high risk. Please consult a SEBI-registered advisor before making investment decisions. FinScann and its authors are not responsible for any financial losses.